If you want to become a successful Bitcoin trader in the 2020s, keep reading.

Bringing a Bitcoin and blockchain-based solution to the financial issue is a significant innovation for the industry. Blockchain technology has been implemented in many industries.

Still, few are more complicated than supply chains, which are heavily regulated by various parties and require numerous interactions involving exchanging goods and services.

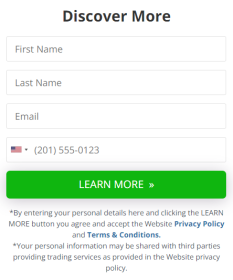

Click on the image to learn how you can analyze the Bitcoin market without professional help.

There has never been a better time to get involved with bitcoin trading because of significant overall growth in crypto markets such as Bitcoin.

Recommended: How to Make $250 a Week: 17 Legit Methods

However, it’s essential to do your research and know what you are getting into before you start trading cryptocurrencies like BTC or others such as Ripple.

This article will provide new traders with knowledge on how to buy an altcoin like Bitcoin and earn profits from it through fine BTC trading tips that bring success for traders.

How to Become a Successful Bitcoin Trader: 13 Practical Hacks

Hedging Bitcoin

The first rule of fine BTC trading tips is the trade with a small amount of capital. As the trading volume increases, the stop loss moves closer to breakeven.

So, if you are still new to crypto trading, try to start with a small amount and increase your amount when you have gained experience and confidence in this business.

Trend Lines

Find out which direction the coin is moving in terms of price movements and keep checking it so that you are always aware of what’s happening. Moving averages may give us some insight into this as well.

These are the numbers you can use to determine the trend of a coin, which is your primary source of information when trading. Drawing trend lines can be a very powerful strategy you can implement to make profit most of the time from the crypto market.

The good thing is, if you want to become a successful trader, there are hundreds (if not thousands) of resources on the internet about drawing trend lines accurately. Once you’re good at making use of trend lines, this alone can make you 10 times more of a better trader than you could’ve ever been.

Always Trust Your Gut

Trading is hard because even the most educated people can get fooled into getting caught up in the hype and overdoing it with their investments.

It is why people need to trust their guts when it comes to making decisions about crypto trading. But, of course, you should be safer than sorry, so it makes sense that you would want to watch out for red flags when making your decisions about trades.

Bitcoin Breakout Strategy

You have to watch out for the Bitcoin breakout strategy. First, it’s important to note that most trends start at the beginning of a trading day or before.

You can enter a trade if the price is heading upward, but after a few hours, you should be looking for another opportunity to enter. The bitcoin breakout strategy has been popularized by traders and investors such as Warren Buffet, Jamie Dimon, and George Soros.

Understand the Bitcoin Market

The bitcoin market is relatively new, so there are not a lot of established trading rules when it comes to this area. It means that investors and traders must do a good amount of research before they commit to informed trading decisions.

It can be difficult for many beginners and make them skeptical of trying to get into crypto trading. However, understanding the market’s workings is essential before you move forward with your trades.

Learn Fundamental Analysis

It often involves interpreting supply and demand in the crypto markets. In addition, fundamental analysis requires looking at a coin’s historical market data, price highs and lows, and market cap growth.

As a trader, you need both of these things to decide if it’s worth your time or not! Most of the time, the market will run in the direction of the news; which is the backbone of fundamental analysis.

So, it beckons on your ability to determine if the news is a good one or a bad one. If it’s a good one, then you can go in for a buy strategically. If it’s bad news, it means the market will be headed down soon. And it makes sense to sell in the futures session.

Crypto Trading Tips

Don’t be risk-averse when trading bitcoin for profits. Try to understand which coins make more sense for you and your portfolio.

Keep your emotions at bay when investing in crypto. Sometimes it can be tempting to take a trade just because you think you’re going to profit, but only very rarely do all trades proceed as predicted.

It’s essential to look at the fundamentals of any coin before placing an order to buy it and not make the same mistakes that many do when they gamble on price movements. If a coin has a significant issue with its code or has been hacked, then that could spell disaster for people using the coin altogether.

Build a Trading Plan

Before you start making market predictions and trades, building a trading plan for Bitcoin is a good idea. Mostly, people use many bitcoin trading strategies to trade cryptocurrencies. A few of the best ones include Technical Analysis, Fundamental Analysis, and Sentiment Analysis.

Technical analysis is based on historical data, while fundamental analysis endeavors to predict future movements based on modern trends. Trading sentiment analysis utilizes fundamental analysis while also taking into account past experiences.

Manage Your Risk

To minimize your risk, you need to understand your risk. It’s not hard to get caught in trading positions that are far beyond your means. But remember that the risk will make you a profit or no profit.

Risk management is perhaps one of the most important aspects of trading crypto. If you want to become a better crypto trader, understand your risk at all times. Understand how much risk goes with every trade. If it’s a lot of risk for less profit, then it’s a trade not worth taking.

If it’s minimal risk for more money, then it’s gotta be a good trade. Risk management is the core of successful crypto trading. It shouldn’t be about how much money you’re looking to make. But rather, it should be about how much money you’re putting on the line for each trade.

Successful trading is about making profit every time. But it’s about making profits with minimal risks. You could risk 10% of your capital to make 40%. Now that’s a good trade.

But a bad trade is risking that same 10% to make a profit of 5%. It’s a really terrible trade. Much more than understanding the risk to every trade, also critically understand risk management techniques and strategies to minimize the risks.

Stop-Loss Orders

Stop-loss orders are an excellent way to ensure you don’t lose out on a trade. They are instrumental when you’re following a trend. It is the most common trading strategy, and successful traders don’t hesitate to use it.

However, once The Trend Starts To Reverse, you need to get out of the trade before you go further in. It’s important not to be overzealous when trying to make money in crypto trading, but it’s also important not to give up too soon if things aren’t going your way.

Use Bitcoin Trading Bots

Trading bots are computer programs that run automated algorithms on your behalf when you’re not online.

They allow you to make trades faster, but for some people using them, it could mean the difference between a prosperous trade and a failed one. Notice that risk is high when using these trading strategies, so you should use them only if you know what you’re doing or if you’ve done your research.

Use Technical Indicators

Technical indicators can help to foreshadow the movement of price; by doing so, they can help your predictions be more accurate than otherwise. You can watch for indicators like the Moving Average Convergence Divergence (MACD) indicator.

If you want to become a successful Bitcoin trader or a successful crypto trader, then you’ll need to understand at least the basic indicators in the charts. However, it’s a totally bad idea to trade with indicators. Or to trade in isolation using indicators – this means trading with just one indicator.

These tools on your charts are misleading sometimes. They lag. They move after the price has moved. That’s a confirmed reality. That notwithstanding, you can make use of some good ones to complement your price action trading strategy.

Recommended: Starting Over at 40 After Divorce: 9 Hacks You’ll Ever Need

Learn How to Read Candlesticks

Candlesticks are very important in terms of understanding how to read charts and plot points on them. They show you a lot of information that could help you decide when to buy or sell a coin, so learn as much as possible about them if you want to become a successful Bitcoin trader.

Plus, this is also important if you want to get in and out of the market as a day trading scalper. Cryptocurrency scalping happens within minutes, and you need to understand the different candlestick patterns to execute successful trades.

Every candlestick tells a story.

How to Become a Successful Bitcoin Trader: 13 Practical Hacks – Summary

When it comes to trading the crypto market, you’ll need to understand that knowledge is power. With the knowledge of trading, there’s a lot of money to be made. But without knowledge, you’re in for a fatal loss. Crypto trading is profitable, but this is if you understand the entire scope of trading and investing in the market.

Other than trading, you’ll need to know exactly how to make the right investment decision when it comes to investing in crypto. With lots of alt coins out there, thorough research is pertinent to make the right crypto investment decision.

In brief, some of the practical success for BTC trading and investment success include having an understanding of candlestick patterns, using trading bots, understanding technical indicators, having a trading plan, managing risks, understanding the Bitcoin market, fundamental analysis and breakouts.

You’ll also need to follow your guts sometimes, understand trend lines, and understand Bitcoin hedging.